Introduction

Kenya’s real estate sector, a significant contributor to the nation’s GDP, is increasingly influenced by global economic dynamics. As international markets evolve, their ripple effects are felt in property investments, construction costs, and housing demand within Kenya. Understanding these global influences is crucial for stakeholders aiming to navigate the Kenyan real estate landscape effectively.

1. Global Monetary Policies and Interest Rates

Global interest rate trends, particularly in major economies like the U.S. and the Eurozone, have a direct impact on Kenya’s financial environment. For instance, when the U.S. Federal Reserve adjusts its rates, it influences capital flows into emerging markets, including Kenya. Higher global rates can lead to capital outflows from Kenya, prompting the Central Bank of Kenya (CBK) to adjust its own rates to stabilize the shilling and control inflation. In February 2024, the CBK raised its base lending rate to 13.00%, the highest in over a decade, to curb inflation and support the Kenyan shilling.

These adjustments affect mortgage rates and the cost of financing real estate projects, influencing both developers and potential homeowners.

2. Foreign Direct Investment (FDI) and Capital Inflows

Global economic stability plays a pivotal role in determining the flow of foreign direct investment into Kenya’s real estate sector. Periods of global economic growth often see increased FDI, with investors seeking opportunities in emerging markets. Conversely, global economic downturns can lead to reduced investment as investors become more risk-averse.

Kenya has witnessed significant FDI in its real estate sector, particularly in commercial and residential developments. However, global economic uncertainties can lead to project delays or cancellations, affecting the sector’s growth trajectory.

3. Currency Fluctuations and Import Costs

The strength of the Kenyan shilling against major currencies influences the cost of importing construction materials, many of which are sourced internationally. A weaker shilling makes imports more expensive, increasing construction costs and, subsequently, property prices. This scenario can deter potential buyers and investors, slowing down the real estate market.

Moreover, currency volatility can impact the repayment of foreign-denominated loans taken by developers, affecting their financial stability and project completion timelines.

4. Global Supply Chain Disruptions

Events such as the COVID-19 pandemic have highlighted the vulnerabilities in global supply chains. Disruptions in the supply of construction materials can lead to project delays and increased costs. Kenyan developers reliant on imported materials face challenges in sourcing and budgeting, which can impact project feasibility and timelines.

Diversifying supply sources and investing in local manufacturing can mitigate these risks, ensuring more stable project execution.

Photo by Engin Akyurt

5. Technological Advancements and Digital Transformation

Global technological trends are reshaping the real estate sector. The adoption of PropTech solutions, such as virtual property tours, online listings, and digital transaction platforms, has been accelerated by global digital transformation. Kenyan real estate firms integrating these technologies can enhance customer experience, broaden their market reach, and streamline operations.

Staying abreast of global tech trends ensures competitiveness and aligns with the evolving preferences of tech-savvy consumers.

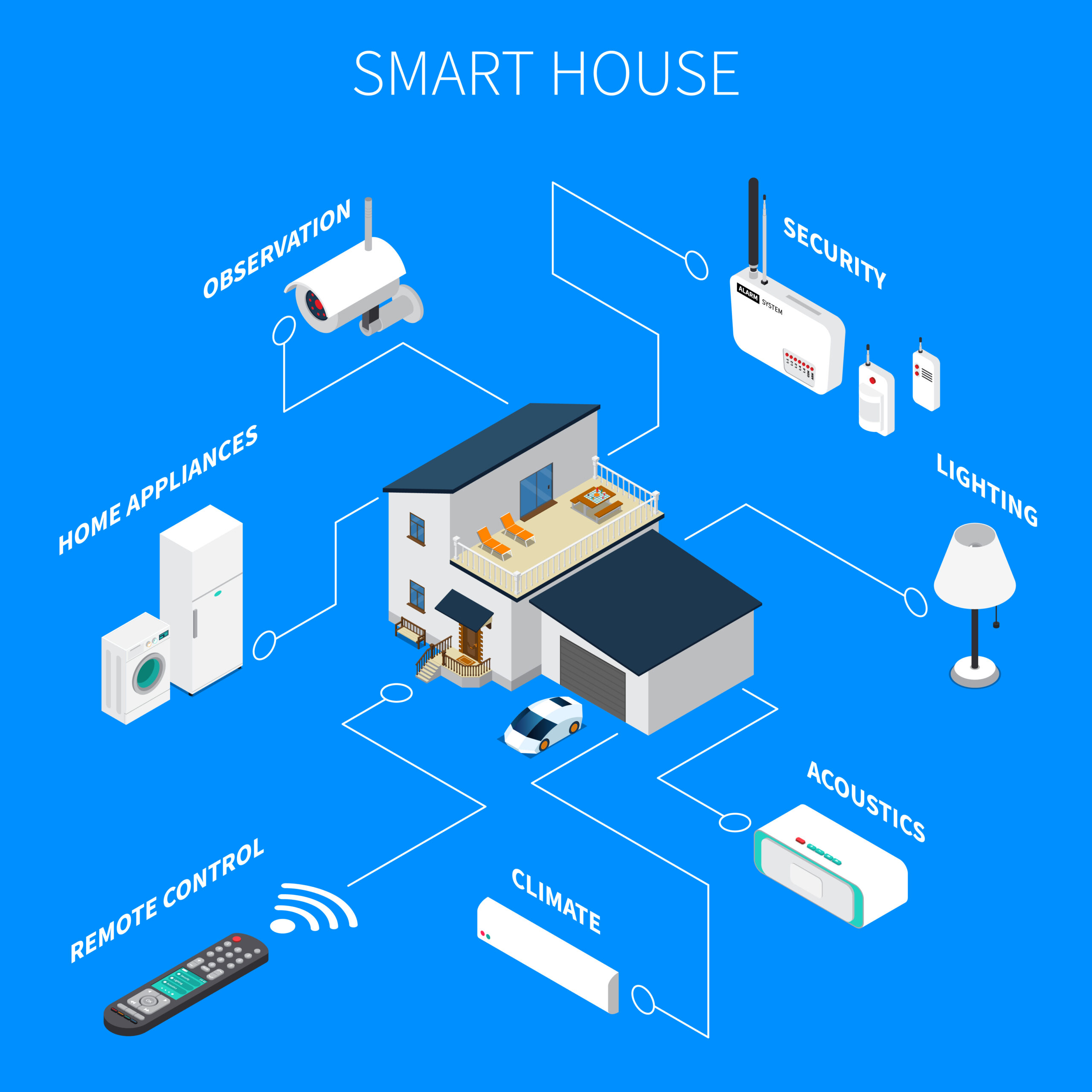

Photo by Macroveter on Freepik

Conclusion

Global economic trends have a profound impact on Kenya’s real estate market. From influencing investment flows and construction costs to shaping consumer behavior and technological adoption, these global factors are integral to the sector’s dynamics. Stakeholders must remain vigilant, adapting strategies to mitigate risks and capitalize on emerging opportunities in an interconnected global economy.